23+ Ltv mortgage calculator

The loan-to-value LTV is expressed as a percentage showing the size of your loan in relation to the. Work with Americas 1 online lender to lower your payment or consolidate debt.

Cityscape A Journal Of Policy Development And Research National Survey Of Mortgage Originations

The algorithm behind this LTV calculator applies the fomula explained here.

. Account for interest rates and break down payments in an easy to use amortization schedule. Loan-to-value becomes a key. To find out your LTV simply divide 200000 by 250000 and then multiply by 100.

For instance lets assume you own a home that costs 300000 and your current mortgage balance was 240000. To see how the loan-to-value LTV formula works heres the basic formula and an example. Buy To Let Calculator h2.

Take what you want to borrow or already owe and divide by the value of the property. This is best shown by way of an example. Mortgages advice services provided by LC 0844 776 1076.

Loan pay-off date 30547814 Total Interest Paid 20000 Monthly Tax Paid 7200000 Total Tax Paid 8333 Monthly Home Insurance 3000000 Total Home Insurance 2424927 Annual. Ad Want to Know How Much House You Can Afford. The LTV Loan to Value Calculator helps you understand what loan to value is how it affects your mortgage loan and what level of loan to value applies to you.

Next provide the appraised value of the property. Use our free mortgage calculator to estimate your monthly mortgage payments. If you own a home worth 1000000 and get a new first.

Get A Loan Estimate From Top Lenders Today. It is used by lendersreditors when analyzing whether a borrower is qualifying for a new mortgage or not. Ad Top Home Loans.

Its Never Been A More Affordable Time To Open A Mortgage. Ad Top Home Loans. Typically a loan-to-value ratio should be 80 or less to avoid having to add PMI.

Calculate Your Mortgage Savings. Phone assistance in Spanish at 844-4TRUIST 844-487-8478 option 9. The Consumer Financial Protection.

A Loan-to-Value ratio for a property is equal to all mortgages on a property divided by the appraisal value of the property. Our Loan to Value LTV Calculator is easy to use. Ad Get started now on other refinance options you may qualify for with Quicken Loans.

If you are purchasing a home the property value would be the purchasing price of the home while the. To calculate LTV you would divide the mortgage amount over the property value. Loan-to-value LTV is the ratio of mortgage to property value expressed as a percentage.

For example if you have a mortgage of 150000 on a house thats worth 200000 you have a loan-to-value of 75 therefore you have 50000 as equity. You only have to enter two components to learn your loan to value. How to work out the LTV This is a simple calculation.

See Up to 5 Free Loan Quotes in Minutes. The Loan to Value Ratio LTV shows how much equity you have in a house relative to the amount you want to borrow or already have borrowed and is one of the key risk factors. For example if youre buying a 100000 property with a 10000 10 deposit youll need a 90.

Lastly hit the Calculate. HOW TO CALCULATE LTV WITH OUR ONLINE TOOL. Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home.

Loan Amount Value of the Home After you have entered this. LTV mortgage balance home value x 100. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

This gives you an LTV of 80 so you should look for mortgage deals that are available up to 80 LTV. For assistance in other languages please speak to a representative directly. First of all enter the borrowing amount in the space provided.

Find A Great Lender Today.

![]()

Aloha Capital Biggerpockets

Learn Real Estate Math Quizlet Real Estate Exam Math Methods Math

2

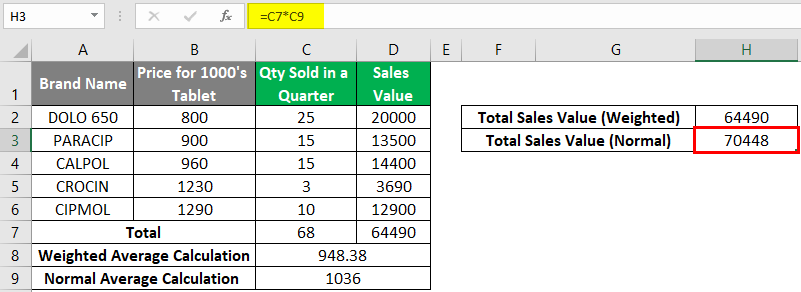

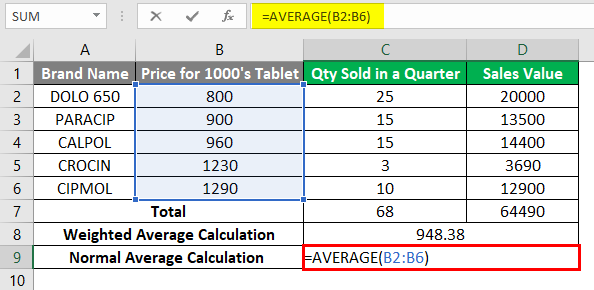

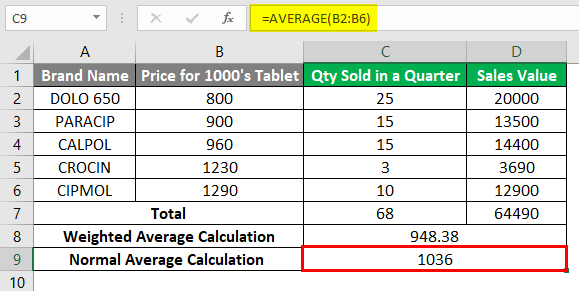

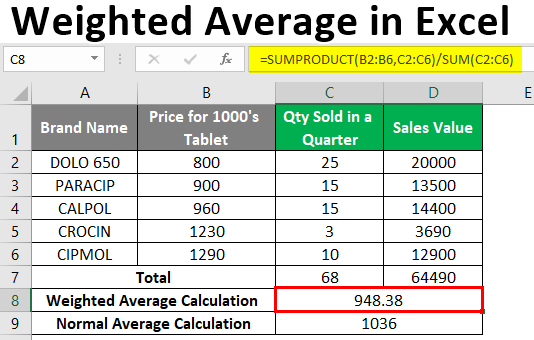

Weighted Average In Excel How To Calculate Weighted Average In Excel

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

2

Mortgage Payoff Watches Refinancing Mortgage Mortgage Payoff Mortgage Interest Rates

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Loans

Mortgage Insurance When Is It Required Mortgage Protection Insurance Refinance Mortgage Private Mortgage Insurance

Weighted Average In Excel How To Calculate Weighted Average In Excel

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

Loan Product Menu Flyer Usda Loan Marketing Flyers Menu Flyer

Weighted Average In Excel How To Calculate Weighted Average In Excel

Weighted Average In Excel How To Calculate Weighted Average In Excel

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

Working Capital Needs Calculator Plan Projections Business Planning Business Planner How To Plan